I am pleased to share with you our latest Market Report for the San Francisco Bay Area. The report begins with economic and real estate commentary presented in partnership with the Rosen Consulting Group (RCG). For the statistical report of the regional housing market, we look at the ten counties associated with the SF Bay Area, focusing primarily on detached single-family homes, with added coverage of the significant condominium market in San Francisco. Enjoy the information and insight provided in the report and I look forward to discussing the market with you.

UPSWING IN SUMMER SALES

The housing market headed towards the end of summer on a positive note with home sales on the rise. The recent drops in the mortgage rate helped some buyers to come off of the sidelines and more homes put on the market gave these potential buyers more options.

The SF Bay Area economy continued to expand, particularly with stronger hiring in the inland counties, though the tech sector remains somewhat of a drag on economic performance. Hiring was up while unemployment trended lower even as some firms announced additional rounds of layoffs. Recent losses in the stock market may constrain some housing activity in the near term, though overall equity indexes remain positive for the year.

MORE TO CHOOSE FROM

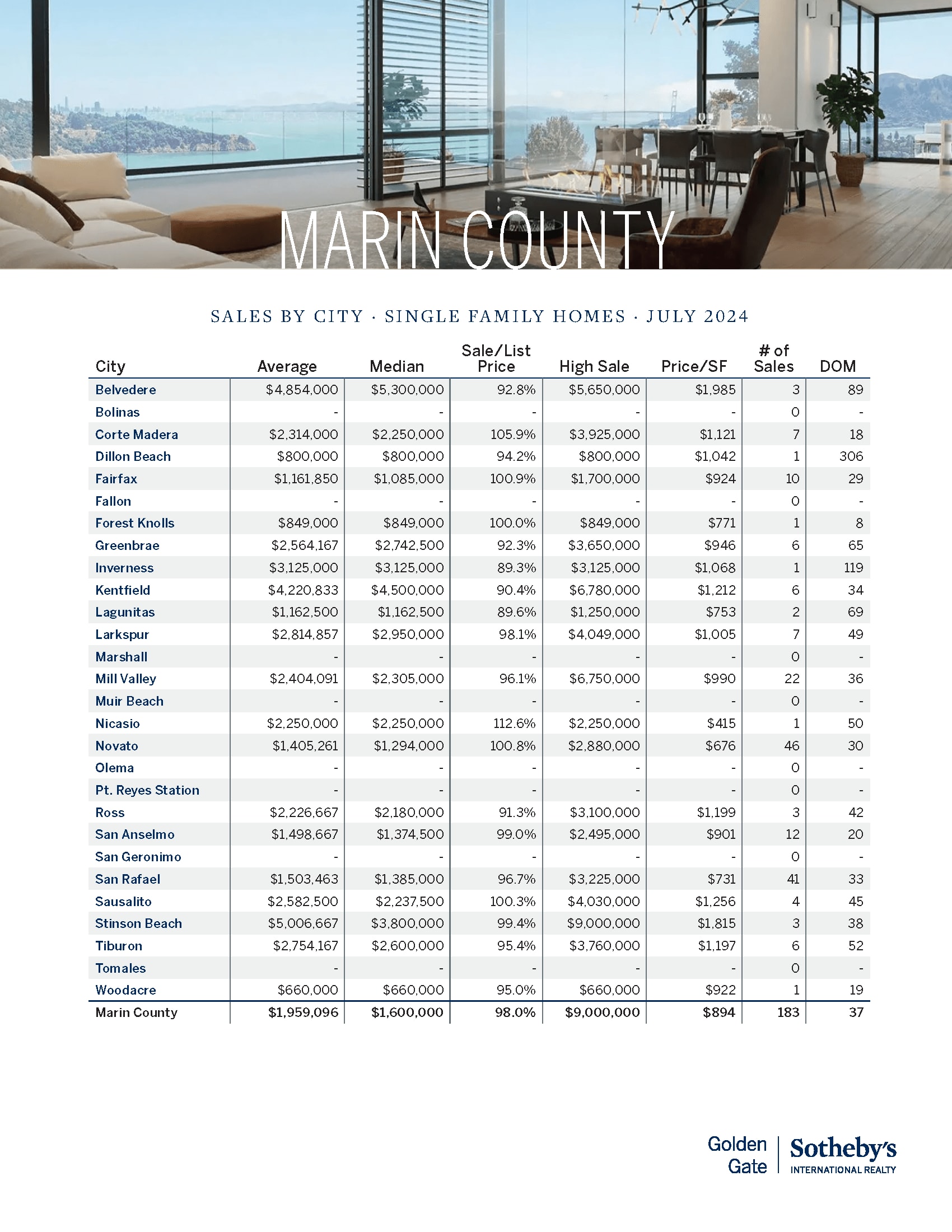

Available inventory continued to increase with nearly 6,500 homes available for sale in July. This was an increase of nearly 3% from June and 33% from one year ago. The greater availability of homes for sale is a positive for potential buyers and yet active listing volume remains lower than market equilibrium. Inventory increased at the greatest rates in Alameda, Napa, San Mateo and Sonoma counties. On the other hand, the number of available homes decreased in Marin, San Francisco and Santa Clara counties.

DEEP DEMAND PUSHES SALES

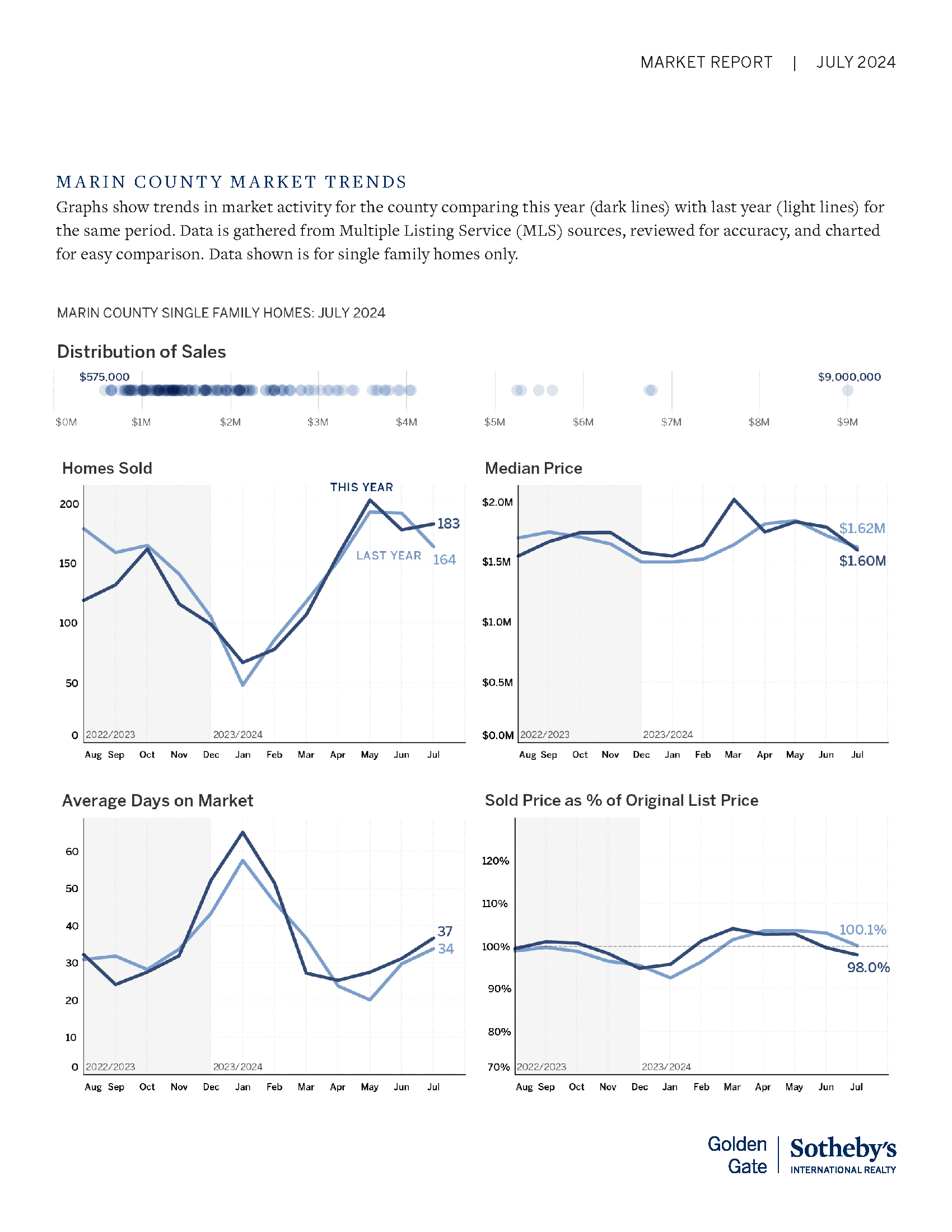

Sales activity increased slightly in July with more than 3,800 homes sold across the SF Bay Area, a positive sign following the modest dip in June. Compared with one year ago, roughly 18% more homes sold, an indication both of the depth of housing demand in the region and that buyers will respond as mortgage rates come down. By county, the most significant increases in activity from the previous month were in Alameda, Napa, Santa Cruz and Sonoma counties. Sales volume increased for the sixth-consecutive month in Sonoma County, the longest such streak in the region.

STOCK MARKET MAY BE SLOWING HIGHER END SALES

Sales velocity at the upper end of the pricing spectrum slowed in July after a strong showing during the previous three months. The weaker stock market as well as tech industry performance may be coming through in slower sales of higher-priced homes. In San Francisco, San Mateo and Santa Clara counties, sales of homes priced greater than $5 million declined substantially in July. Throughout the SF Bay Area, sales of the most affordable homes continued to outperform. During July, sales of homes priced less than $1 million increased by nearly 10%. Many of these buyers are sensitive to fluctuations in the mortgage rate, and recent decreases in rates improved affordability for these households.

HOMES STILL MOVING QUICKLY

Buyer competition persisted even as the rise in inventory brought more choices in most neighborhoods. The average time on market increased slightly to 26 days, an increase of roughly 2 days from June yet more than 2 weeks faster than the beginning of the year. Though the average marketing time increased in most counties, homes sold more quickly in Napa, San Francisco and Santa Cruz counties in July.

LOOKING AHEAD

The resiliency of the SF Bay Area housing market continues to stand out from metropolitan areas across the country. Should mortgage rates continue to edge lower, the number of potential buyers will grow as more households seek homes in desirable neighborhoods while the increased activity should encourage more trade-up buyers to list their current homes for sale. As we continue into the second half of the year, buying activity should persist and home prices should remain higher than last year. Unlocking homeowners who are ready to buy larger homes or move to better neighborhoods but are held captive by their in-place mortgage rate will remain key for the long-term health of the housing market.

If you want to buy or sell a home or have questions about the Tiburon real estate market, contact Phillipa Criswell today.